I love cars and think getting a loan should be easy. That’s why I’m excited to talk about Nissan Finance. They’ve changed how we get auto loans and payment options.

Nissan Finance is a trusted name in cars. They offer financial solutions made just for Nissan customers. At a Nissan dealership, you’ll meet experts ready to help you buy a car.

Nissan Finance makes getting a loan simple. They have flexible plans and reasonable rates. This means you can find a payment that works for you, whether a new or used Nissan.

Key Takeaways

- Nissan Finance offers easy and accessible auto loan options for Nissan customers.

- Flexible payment plans and competitive interest rates make financing a Nissan vehicle more affordable.

- The Nissan Finance team provides personalized guidance to help customers navigate car-buying.

- Customers can explore a range of financial products, including leasing and special financing deals.

- Nissan Finance’s online tools and resources simplify financing, empowering customers to make informed decisions.

Understanding Nissan’s Financial Services Overview

Nissan knows buying a car is a big deal. They offer complete financial services through Nissan Motor Acceptance Corporation (NMAC). NMAC helps with Nissan Motor Acceptance Corporation, dealer services, and financing offers, making buying a car easy and worry-free.

The Role of Nissan Motor Acceptance Corporation

Nissan Motor Acceptance Corporation is Nissan’s financial side. They provide many financing options and services. NMAC works with Nissan dealerships to offer reasonable financing and easy payment plans.

Benefits of Choosing Nissan Financial Services

- Competitive interest rates and flexible terms to fit your budget

- Hassle-free application and approval process

- Seamless integration with Nissan’s dealer network

- Personalized support and guidance throughout the financing journey

Available Financial Products Overview

Nissan’s financial services offer many products for different customers. They offer Nissan Motor Acceptance Corporation loans for new and used cars and special financing for first-time buyers.

“Nissan Financial Services has made the car-buying process so much easier for me. The team was knowledgeable, responsive, and helped me find the right financing option to fit my needs.”

– Emily S., Satisfied Nissan Customer

How Nissan Finance Makes Car Buying Simple

Buying a car can seem like a daunting task, but Nissan Finance wants to make it easy for you. They offer simple car financing options and a straightforward credit approval process to get the car you want quickly.

Nissan Finance makes things easier wittierflexible payment options. You can pick from auto loans, lease agreements, or special deals. These options are designed to fit your needs and budget.

- Straightforward credit application and approval process

- Variety of car financing plans to suit different financial situations

- Transparent and competitive interest rates and APR options

Nissan Finance wants to make buying a car simple. They help you focus on finding the right vehicle, not dealing with complicated finance stuff. Nissan is all about making things easy and satisfying for their customers.

“Nissan Finance’s streamlined approach to car financing and credit approval has been a game-changer for our customers. They can now enjoy a stress-free car-buying experience, from start to finish.”

Exploring Auto Loan Options Through Nissan

Nissan has many auto loan programs to fit your needs. Whether you want a new or used car, Nissan’s team will help you. They’ll find the best option for you.

New Vehicle Financing Programs

Nissan’s new car financing has excellent rates and flexible plans. You can get a new Nissan with little to no down payment, making buying a new car affordable.

Pre-Owned Vehicle Loans

Nissan also offers loans for used cars. Their certified pre-owned vehicles are high-quality and low mileage. You get the same financing benefits as a new car.

Special Financing Deals for First-Time Buyers

Nissan knows buying a car can be challenging for first-timers. They have special programs for you. These programs have flexible terms and reasonable rates to help you feel confident.

“Nissan’s auto loan options have been a game-changer for me. The team worked closely to find the perfect financing solution that fit my budget and needs.”

– Sarah, Nissan Customer

Competitive Interest Rates and APR Options

Read Also:Kia Finance: Flexible Auto Loans & Payment Options

Nissan Finance offers interest rates and Annual Percentage Rate (APR) options that are hard to beat. These deals help customers get the car or truck they want without overspending. It’s all about finding the right fit for your budget.

Nissan’s low APR offers are often much lower than what other lenders charge. You’ll pay less each month and save a lot in the long run. Plus, Nissan’s flexible financing lets you customize your loan to fit your life perfectly.

| Financing Option | Nissan APR Range | Industry Average APR |

|---|---|---|

| New Vehicle Loans | 0.9% – 4.9% | 5.27% |

| Pre-Owned Vehicle Loans | 2.9% – 6.9% | 7.42% |

| First-Time Buyer Financing | 1.9% – 5.9% | 6.84% |

Nissan Finance makes it easier to get the car you’ve always wanted. With competitive interest rates and low APR options, you can make intelligent choices. Nissan is about helping you find the best deal and keeping your finances in check.

Flexible Lease Programs and Terms

Nissan offers many car and vehicle leasing options to fit your unique needs and budget. Nissan’s Financial Services team helps you find the best payment options for your lifestyle.

Standard Lease Arrangements

Nissan’s standard lease agreements are affordable and flexible. You can choose from different lease terms and mileage allowances. This way, you can adjust your monthly payments to fit your driving habits and budget. Enjoy the latest Nissan models without a long-term commitment.

Sign & Drive Options

Nissan’s “Sign & Drive” leasing program is all about convenience. You can sign the paperwork and drive off the lot right away. Your first month’s payment is waived, making it easy to get your dream Nissan.

End-of-Lease Choices

- Purchase your leased vehicle at the pre-determined residual value

- Return there and walk away with no further obligations

- Explore the option to lease or finance a brand-new Nissan model

Nissan’s flexible lease programs help you find the right financing solution. Whether you like the simplicity of a standard lease or the ease of a Sign & Drive option, Nissan has you covered.

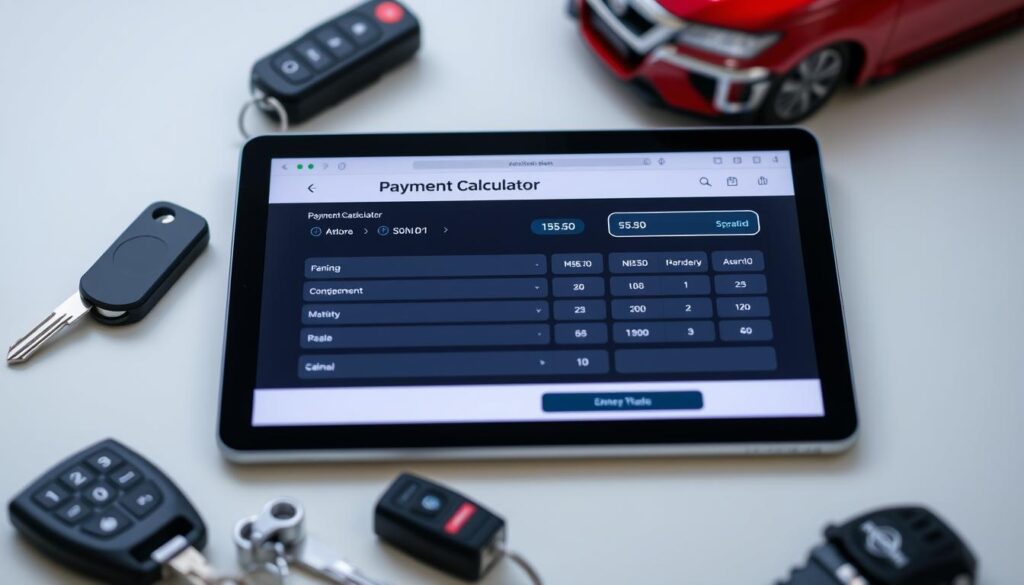

Online Payment Calculator and Tools

Financing a new car can seem overwhelming, but Nissan simplifies it with its online tools. The payment calculator is at the centre, helping customers figure out monthly payments. It also lets them check out different auto loans and financing offers that match their budget.

The payment calculator is easy to use. Enter the car’s price, down payment, loan term, and interest rate. Then, you’ll see an estimate of your monthly costs right away. This tool helps you make smart choices and find the best financing.

Nissan’s website has more than just a payment calculator. You can compare auto loan options, look at leasing programs, and even get credit pre-approval online. This makes buying a car easier and lets you manage your financing on your terms.

Whether buying your first car or upgrading, Nissan’s online tools greatly help. They offer precise info and personalized help, making finding the right financing for your next Nissan easy. With these resources, getting your next car is more accessible than ever.

Special Dealer Incentives and Promotions

At Nissan, we make buying a car fun and rewarding. We offer many special deals and promotions to help you save. Our finance team works hard to give you the best deals, whether you’re a graduate, in the military, or just looking for a great deal.

Seasonal Offers and Deals

Nissan dealers offer special promotions throughout the year. These incentives include cash back, low APR financing, and free accessories. Check our website or ask your local dealer for the latest financing offers.

Graduate and Military Programs

Nissan supports your education and service. We have special programs for recent graduates and military members. These programs offer exclusive dealer incentives and low APR financing, making it easier to drive your dream Nissan.

Loyalty Rewards

We appreciate our loyal customers at Nissan. That’s why we have a Loyalty Rewards program. It gives you special dealer incentives and financing offers if you’ve bought or leased a Nissan. It’s our way of saying thank you.

Want to know more about our dealer incentives, financing offers, and low APR deals? Visit your local Nissan dealer or check our website. We’re here to help you find the perfect car at a great price.

Credit Application Process and Requirements

Getting an auto loan with Nissan Finance is easy. Whether you’re buying your first car or have done it before doesn’t matter. Knowing what you need for your credit application makes the process smoother.

Preparing Your Application

To start, you’ll need some documents:

- Proof of income, like recent pay stubs or tax returns

- Identification, such as a driver’s license or state-issued ID

- Proof of insurance

- Details about the car you want, like make, model, and year

With these documents ready, you can confidently apply for credit approval. You can do this online or at your local Nissan dealership.

Improving Your Chances of Approval

To get better auto loans, keep your credit score high and show you can handle money well. Here are some tips:

- Check your credit report and fix any mistakes

- Pay off debts and use less of your available credit

- Make a significant down payment to lower the lender’s risk

By following these steps, you’ll look like a trustworthy borrower. This can help you get Nissan’s finance approval.

The Nissan Finance team is here to help you find the right loan. They’ll guide you through the application process. With their help, you can get the Nissan you want.

Managing Your Nissan Auto Loan

Navigating payment options and loan management can be challenging. But Nissan Financial Services is here to help. We offer tools and support for managing your auto loans effectively, whether you’re new or experienced.

Flexible Payment Options

Nissan knows everyone’s financial situation is different. That’s why we ofofferrious payment options. You can choose the one that fits your budget lifestyle.

- Online and mobile payment platforms for easy, on-the-go management

- Automatic payment options to ensure timely loan instalments

- Customizable payment schedules to accommodate your cash flow

Hassle-Free Account Management

Managing your Nissan finance account is now easy. Our online portal and mobile app give you 24/7 access. You can check your balance, make payments, and view history with just a few clicks.

| Feature | Benefit |

|---|---|

| Online Account Dashboard | Centralized access to all your loan information |

| Mobile App | Manage your account on the go, anytime, anywhere |

| Paperless Billing | Reduce clutter and access your statements digitally |

Early Payoff and Refinancing Options

If you can pay off your auto loans early, we have options for you. Our refinancing programs can also help you get a lower interest rate or adjust your loan terms.

“Nissan Financial Services has made managing my auto loan a breeze. The online tools and payment flexibility have taken the stress out of the equation.”

At Nissan, we aim to make payment options easy and stress-free. Whether you need help managing your loan or want to improve your financial strategy, our team is here to support you.

Vehicle Protection and Extended Service Plans

Nissan Finance knows how important it is to protect your vehicle investment. They offer various protection and extended service plans, which aim to improve your driving experience and give you peace of mind.

Available Protection Packages

Nissan’s protection packages cover many potential issues with your vehicle. They include coverage for mechanical breakdowns, wear and tear, and accidental damage. You can pick a plan that fits your needs and budget.

Service Contract Options

Nissan Finance also offers different service contract options. These contracts offer extended warranty coverage and ensure your vehicle is serviced by certified Nissan technicians using genuine Nissan parts. You can choose a contract that matches your driving habits and preferences.

Gap Insurance Coverage

Nissan Finance offers unique gap insurance coverage. This coverage helps pay the difference between your loan balance and your vehicle’s actual cash value if lost or stolen. It provides financial security and reduces financial stress during tough times.

By using Nissan’s vehicle financing and dealer services, you can be sure your Nissan finance experience meets your needs. Check out the protection packages, service contract options, and gap insurance coverage. Find the best solution for your driving lifestyle.

Conclusion

Nissan Finance offers a wide range of auto loan and vehicle financing options. It offers competitive interest rates and flexible lease programs, making buying a car more accessible and fun for customers.

Are you looking for a new or used Nissan? Nissan Finance has financing options to fit your budget and lifestyle. They offer online applications, payment calculators, and a team of financial experts, making getting your dream car more accessible than ever.

Ready to buy a car? Check out Nissan Finance’s impressive offerings. They have competitive rates and flexible lease terms. Start your car-buying journey today and see why Nissan Finance is an excellent choice for your auto loan and financing needs.

FAQ

What is Nissan Finance, and what services does it offer?

Nissan Finance is Nissan’s financial services division. It helps customers buy or lease Nissan vehicles: Nissaninance ofofof offers tons, leasing, and more to make buying a car easy.

What are the benefits of choosing Nissan Finance for my vehicle financing needs?

Choosing Nissan Finance means getting reasonable interest rates and flexible payments. You also get quick credit approval and work directly with Nissan. Plus, there are special deals to make your purchase more affordable.

What types of auto loan and leasing products does Nissan Finance offer?

Nissan Finance offers loans for new and used Nissan vehicles, leasing options, deals for first-time buyers, graduates, and military personnel, and more.

How does Nissan Finance’s credit approval and application process work?

Nissan Finance’s credit application is easy, online or at a Nissan dealer. They look at many factors to approve your credit. They help find the best financing for your budget.

What kind of interest rates and APR options are available through Nissan Finance?

Nissan Finance offers competitive rates on loans and leases. Rates vary by vehicle, credit, and term. But, they aim to be better than the industry average.

Does Nissan Finance have any special financing deals or promotions available?

Yes, Nissan Finance has seasonal deals and incentives. They offer low APRs, zero down payments, and more. These deals are for graduates, military, and loyal Nissan owners.

How can I estimate my monthly payments or compare financing options with Nissan Finance?

Nissan Finance has an online calculator and tools. You can estimate payments, compare loans and leases, and understand financing costs.

What kind of vehicle protection and extended service plans does Nissan Finance offer?

Nissan Finance offers protection packages, extended service contracts, and gap insurance. These give you peace of mind and comprehensive coverage for your Nissan.

How can I manage my Nissan auto loan or lease once it’s in place?

Nissan Finance has tools for managing your loan or lease. You can access your account online, make payments, and refinance if needed.